The term “CRM” doesn’t always conjure up good memories for community banks. You’ve probably heard horror stories and can come up with countless reasons why they don’t work. Why is it so hard to find CRM success?

You may have heard they are expensive, that they fail, or that no one actually uses them. If you have ever tried a CRM, you might remember that implementation was a nightmare, you didn’t get support, or you couldn’t use your data. It may seem like the problems outweigh what is supposed to be your big solution. At the end of the day, it is vital that a CRM helps you to better understand your customer base, but many who have tried have not seen the promised results.

With a new year that poses new challenges, it’s clear that a high-performing CRM platform is required for banks to manage customer data and relationships. But often, community banks lack the depth and breadth of high quality, integrated data they need to help their CRM thrive. Banks hold so much personal data about their customers – more than any other industry. Yet, it remains such a struggle to access it, understand it, or know what to do with it.

How can you know for sure that a CRM will be worth the investment? How long will it take to get it up and running? How do you know if your CRM is a good fit for the industry? How have the requirements changed over the years? We want to assure you that a CRM is an asset to teams of any size because maintaining great customer relationships is no longer a trend, but a necessity in the financial industry. The competition to win over customers will only increase as innovations in technology progress. Is your bank going to be left behind?

49% of CRM projects fail. (Forrester Research) Here’s how to not let that happen this year:

1. Make sure your data is ready

Solve your data dilemma FIRST or face the frustration of coming back to it later. A bank-specific CRM requires clean data to operate properly. You don’t want to set your CRM up for failure with cluttered, incomplete, or incorrect data. Bad data hinders any CRM project and simply won’t help you forge better relationships.

2. Unite your ENTIRE team and keep goals in mind

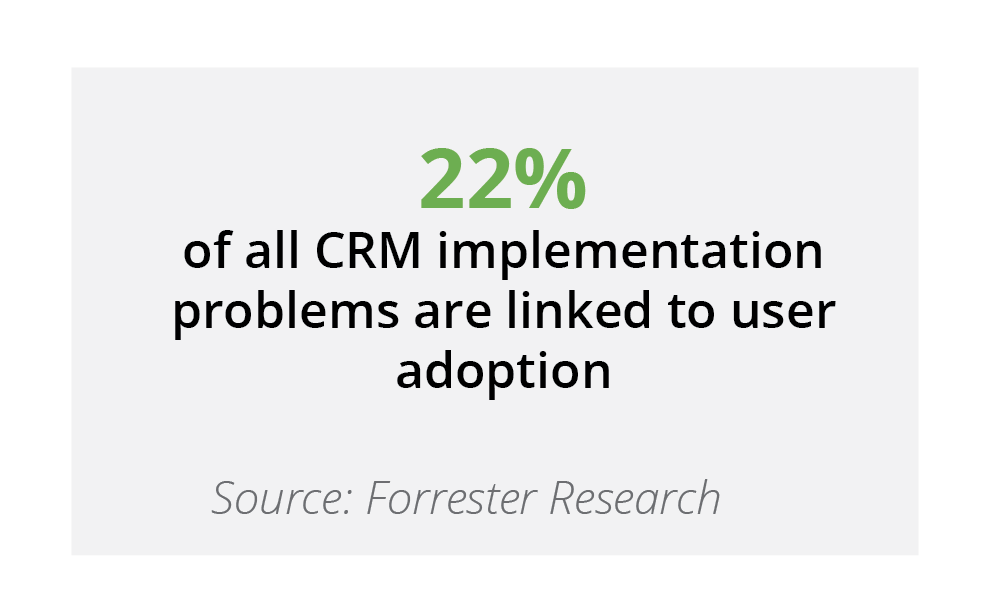

It is of the utmost importance to have EVERYONE on board because your CRM is bound to fail if everyone from executives to the front-line do not share the common goal. Once everyone is engaged, delineate roles and understand how the system can and will work with each role.

It’s also important to understand the costs associated before moving forward. If the system is more expensive than expected or contains hidden fees, your team could face severe disappointment or give up altogether. Your CRM is bound to cost you some money, but the return should be scalable and really felt by your team. You must also understand that learning a new system takes time and patience and no one will be an expert right away. Plan and prepare for training and learning.

One of the main goals of a CRM is to improve productivity, efficiency, and organization for each department involved, therefore it is vital for your entire team to be on board and united.

3. Know your goals and strategies before getting overwhelmed

Financial institutions are inundated with tech choices, so it’s vital to know what you plan to do and WHY. Increased pressures to be high-tech can lead to uninformed decision-making or just being purely overwhelmed and making no decision at all.

What’s your WHY? Do you want to be a more cohesive team? Does your institution want to have better communications with customers? Do you want to implement marketing automation or better marketing in general? Know these things before making the big leap.

4. Things are about to change – be prepared

“This is the way we have always done it” is not going to cut it anymore. If you plan on finding true CRM success, be ready for a change in operations and culture. Making the shift from Excel spreadsheet to fully equipped CRM is bound to disrupt things, but these growing pains are a good thing! It means your institution is taking the necessary steps to compete for potential customers and better serve your current customers. Is your institution ready for change?

5. Use your size to your advantage

Because your community bank is community sized, you are able to give the individual, close-knit experience to your customers – and a CRM eliminates the unknowns you dealt with before. You have the ability to highly personalize each touchpoint throughout their journey with your institution.

Your locality is a great competitive edge because you have an actual, personal relationship with customers. Once all your customer information is in one organized spot in your CRM, you can easily and efficiently deliver a seamless experience to them. You already know what products they have so you can better determine products they actually need. A CRM has given you the ability to sell to them based on their history and trends. Creating this helpful atmosphere leads the customer to trust your advice and judgement, thus inspiring loyalty.

What to look for in a CRM

It’s going to take more than a typical CRM to really inspire the change you want. Technology is much too complicated and expensive to go out and buy each individual piece that you need. Customer relationship management is more than just keeping track of current and potential customers’ profile information. It should also promote organization, efficiency, and high-performance within your team. Using a CRM should be mutually beneficial on the customer side and the employee side. Here’s what to look for in a CRM platform:

Data integration – As we said, LOTS of cleaned and integrated data is required to truly understand your customers. High-quality, available data directly impacts the way you look at your customer needs and solves the data dilemma that so many banks deal with.

Targeting – It can identify new customers and leads and even discovers the needs of your customers. It can show you more than who has product A and not product B, or basic age and income segmentation. This technology predicts the kind of products a customer or prospect has a high propensity to buy, probability to want, or even which customers are most likely to leave.

Marketing Campaigns – this is the best way to leverage your branches as a sales and marketing channel. Smarter marketing campaigns turn valuable data insights into actions that help you grow and meet the changing needs of your customers.

Sales and Service Features – a system must have bank-specific features that aid them in the unique problems banks and credit unions face and help you see the complete view of the customer.

Easy to Use – The whole point of getting a CRM is to make customer relationship management easier. If it ends up being harder than it has to be, your team will not want to use it. This is a major issue that keeps frustrating banks when trying to get their CRM projects off the ground.

Performance Management – You must be able to know whether tasks were completed, with what response, and how quickly. This way you can know just how everything, and everyone is performing. Branch employees benefit from knowing exactly what needs to be done to bring in more business. Visibility is crucial through scorecards, attribution models, and dashboards. Inspiring employees to perform against their goals and knowing exactly what to focus on can be made much easier.

Implementation Tips and Tricks

- Pick a use case where you know users can succeed – When you begin implementation, don’t overdo it. You won’t be able to tackle every project at once, so it’s a good idea to start small with a project you can ease into.

- Do something that creates customer benefit AND generates profit – The result of having a CRM should improve the customer’s journey, and you can create a single campaign that helps the whole thing pay for itself in the first year.

- Do not overwhelm users with an overabundance of features – It’s easy to be drawn in by a CRM’s many flashy features. Features are great but can quickly overwhelm new users if they don’t have a strong basis of understanding the system. Remember that the CRM is supposed to make everything easier, not more difficult or confusing.

- Create a pilot strategy to ensure everyone learns and adopts – Pick a few adaptive users to be the champions of the new system. If their coworkers see success, they will be more willing to adopt.

“Customers now expect exceptional service just as much as an exceptional product.”

Is Your Bank Ready for 2021?

Customers now expect exceptional service just as much as an exceptional product. Bringing that kind of service to them can be your financial institution’s key differentiator against the banking behemoths. Similarly, the financial industry is just going to get more and more competitive as technology budgets increase and more emphasis is placed on customer experience. Online-only banks place a huge importance on customer convenience and experience, and this can easily sway potential customers in their direction. What are you doing to create these experiences for your customers?

A CRM can benefit your community bank, but it is important to do it right the first time. Now is the time to seriously consider marketing and customer experience strategies for the new year. This recipe for success will prepare you to better implement this new system in more ways than just technically. Don’t be one of those left behind.

Want to learn more about growing customer relationships with a CRM?

Like this post? Don’t forget to share!