Community financial institutions must act strategically in adopting modern technologies in a tech-driven era to cultivate sustainable growth.

Artificial Intelligence has been a popular topic in business media for several years, yet many find themselves unsure or wary of its capabilities. What is “Artificial Intelligence”– and can a community financial institution really afford to use it? Today there is more data available than ever before, and we want to show you how to use Artificial Intelligence to your advantage to grow deposits.

What is keeping you from growing deposits? Are you wasting money on services that give you little return on your investment? Are your customers closing accounts faster than they’re opening them? Why is it so hard to gain profitable customers? These challenges show just how difficult it is for financial institutions to grow deposits:

- Up to $500 acquisition cost per customer

- 28% attrition rate for new customers

- 15% attrition rate among current customers

- 65% are single-service households

We want to discuss these different challenges to deposit growth and help you understand how Artificial Intelligence (AI) applies to them. Then, we will reveal how to take the necessary steps in introducing it into your financial institution.

What is Artificial Intelligence?

The term ‘Artificial Intelligence’ is used in lots of confusing and even manipulative ways by technology vendors to draw you in and woo you with tech talk. Why is it important to understand the term? Because technology vendors are updating their terminology faster than the actual technology. This is a challenge when trying to understand the role that AI plays in really solving business problems like deposit growth. There is no real consensus in the financial industry on the definition of Artificial Intelligence, but ultimately the AI term is used to describe the multiple ways that computers learn from patterns of data.

The earliest attempts to learn from patterns of data appeared in the 1500s, starting a chain of new discoveries that would produce more advanced techniques over time. For example, in 1763 Rev. Thomas Bayes developed what would become known as Bayesian Inference, a statistical technique that uses a likelihood function to predict outcomes through observing patterns. This is still the goal for AI today: technology that processes data and searches for patterns in order to predict results.

The Different Components of Artificial Intelligence

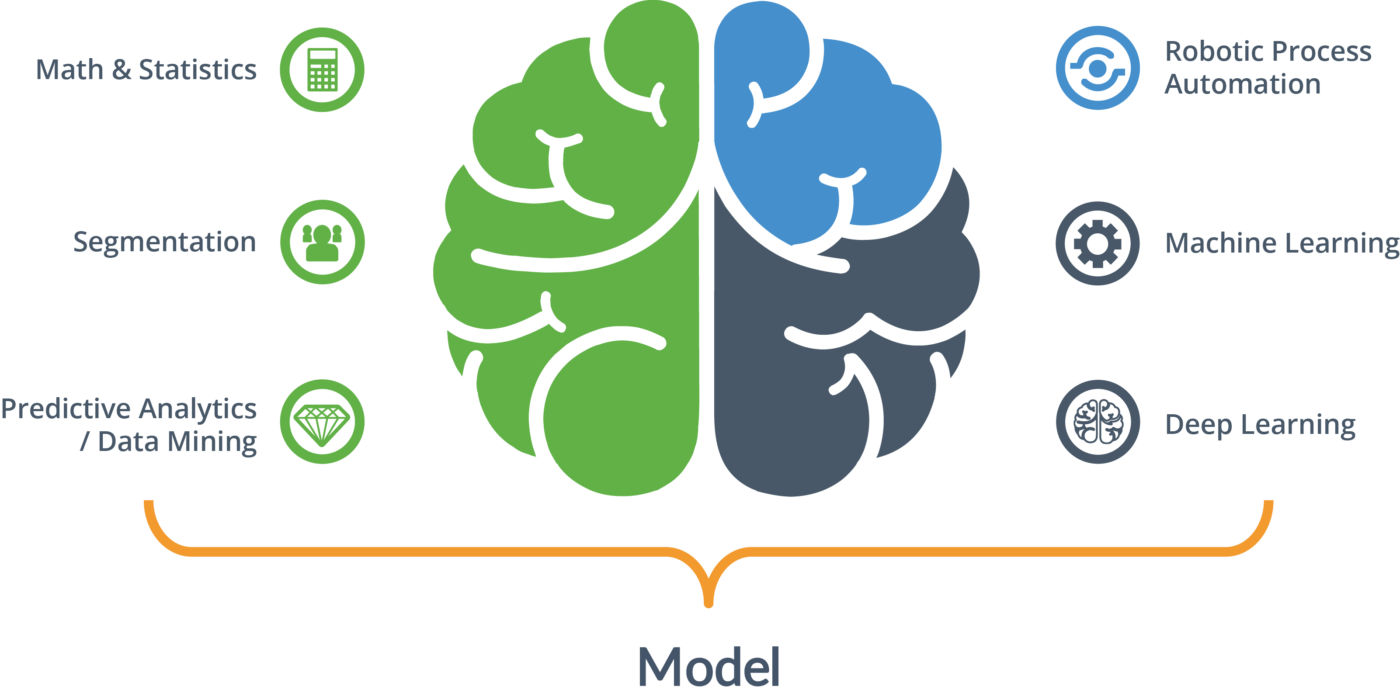

AI is now used as an “umbrella” term to talk about the different components of AI. The most advanced forms of AI technologies today involve a “machine” or “robot” mimicking the thought process of a human. These modern takes on AI are Machine Learning and Deep Learning. From simple math and statistics to autonomous devices and everything in between, uses of AI are affecting many parts of our lives.

Since there are so many ways you can define AI, we want to help you understand it by showing the different techniques and technologies involved. This can help you understand what part of AI different vendors are talking about and how it relates to your financial institution. The graphic below illustrates the many techniques that can fall under the AI term:

The end result of AI is one or more models that contain rules. These rules are applied to new data in order to predict an outcome.

Using its most broad definition, financial institutions have utilized AI through services like FICO credit scores and fraud alerts for many years.

If AI has been around for ages, what’s new?

New Competitors – Financial institutions are facing new competitive pressures from FinTechs and online-only banks. These types of institutions may be using more advanced tech (like AI) to compete against you, and it makes even the best financial institution a little worried that they cannot keep up. A financial institution does not need to question their relevance as long as they take advantage of the tools available to them.

Advanced Algorithms – AI continues to develop with new innovations and advanced algorithms. It seems like every month there is a new algorithm on the scene from the data science community. While this is interesting to observe, these types of developments are rarely applicable to a financial institution’s need to grow deposits.

Open Source Software – For many years, AI tools were very expensive for companies to purchase. Open Source software like “R” and Python give businesses more of an opportunity to adopt software that would have previously cost much more through traditional vendors. Open Source software is often perceived as “free,” but that is far from true. While the software might initially be free, it takes individuals with advanced data science skill sets to use it correctly.

Computing Power – With the huge amount of data we have today, it would have taken older analytical models days to process what can now be done in minutes. Older technology would not have been capable of enabling AI techniques like Machine Learning and Deep Learning. Computing power has increased exponentially and will not stop anytime soon. This massive computing capacity is helpful to financial institutions in optimizing any amount of data quicker than before, while introducing greater marketing agility.

Built-in Applications – Because AI technology can now be built into applications, it is even easier to adopt and leverage your data. Instead of directly using AI to build models, FI Works and other vendors have built ready-to-use, automated AI into their software. For example, financial institutions haven’t ever had to worry about using a FICO score; In turn, it should be just as easy to use AI in marketing as it is to apply a FICO score.

The Process – How to Get Real Results

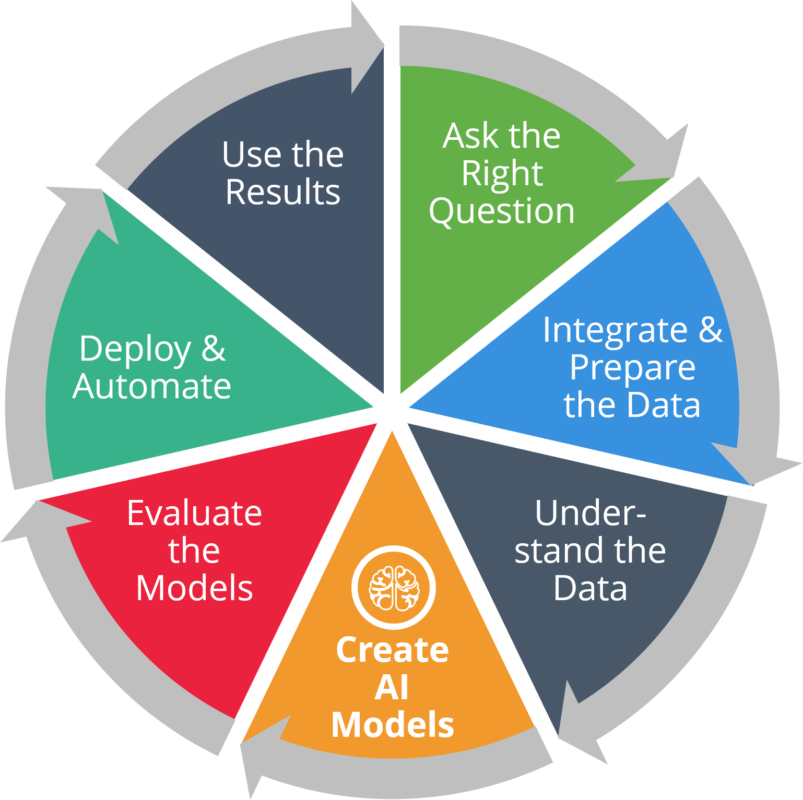

It is important to understand that using AI is part of a data analytics process. The process has multiple steps and none of these can standalone. The picture below shows a broad overview of the data analytics process:

1. Ask the Right Questions – Instead of asking, “which customers have CD’s?” ask: “what customers will add a CD in the next 6 months with the rates we offer?” This will bring about an answer specific to exactly whom you want to target.

2.Integrate and Prepare the Data – You need to clean, integrate, and enhance your data to make it useful to AI algorithms or else a bad model will result.

3.Examine and Understand the Data – Evaluate how individual data elements relate to your business question. Because of the amount of data available, there may be hundreds of data elements to evaluate, and luckily Machine Learning can automate this process.

4.Create the AI Model – The difficulty here is in selecting the right AI algorithm to answer the question being asked.

5.Evaluate the Model – A model must be evaluated to determine how well it performs in making accurate predictions. There are numerous techniques for this, and this process requires a professional with the right technical skills.

6.Deploy and Automate – Even a skilled data scientist can struggle with this step. The technology might be great at creating models, but how do you make predictions a part of your daily marketing operations? You have to get to a place where you can make deposit growth predictions on a daily, ongoing basis.

7.Use the Results – AI can predict outcomes, but you need to have a plan in place to implement the predictions.

So where do you start? Fortunately, financial institutions do not have to do any of this by themselves. This may seem like strenuous work to keep up with, which is why it is important to foster a business partnership that assists you in practical AI implementation. In a few challenging but invaluable steps, your financial institution can be on its way to playing in the same league with the big banks and rivaling the high-tech competition.

Case Study

Deposit Cross-Sell

One of our $4.3 billion community bank clients knew it had a high number of single service households and that there was great potential in getting new deposits within its own customer base.

Although “cross-sell” has gotten a bad name in banking, FI Works suggested using a “look alike” campaign approach to responsibly cross-sell into the bank’s current customers by offering only products they had a high probability of needing.

Direct mail and calling campaigns were executed over eight weeks including follow-up calls. Ultimately, using Machine Learning techniques and FI Work’s advice, this bank won $25 million in new deposit balances with their existing customers.

To reveal just how we got these results, sign up for our webinar here.

Things to Remember

Commitment is key to your success in this type of project. Commit to the process. Commit to implementation and taking the necessary steps. And lastly, commit to a business partner to guide you through the intricacies of the AI world. Once you begin properly implementing AI you must always remember:

- AI can be confusing – you must know which part of AI you need to use to aid deposit growth.

- Use a multi-pronged approach to deposit growth: acquire, retain, and cross-sell.

- It is crucial that you solve your data dilemma FIRST or your results will be meaningless

- AI is NOT a one-time project. It must be integrated into your daily marketing practices if you want results.

- You must commit to a systemic approach to deposit growth. If you don’t, you’ll exhaust yourself and your resources by starting from scratch every time.

- Go beyond direct mail and email campaigns – get bankers involved!

Isn’t Artificial Intelligence expensive and made just for large corporations?

Not quite. AI can be used for any size of financial institution. The financial industry has used limited forms of AI for many years and yet the term has only recently become a hot topic as larger corporations are adopting it. If you think AI might be too difficult or too costly to handle on your own, we are here to help. FI Works uses AI to help grow businesses through our affordable software solutions built specifically for community financial institutions.

Don’t get us wrong – keeping up with AI is hard, but you cannot give up on using it to grow deposits. Engage the right business partner with the right tools to take your services to the next level.

Like this post? Don’t forget to share!