There is a massive amount of hype around millennials in banking. OK, so the hype is all about attracting and banking the new generations of consumers – we get it. But the hype is literally what will make your millennial sales and marketing attempts fail. Let’s look at why.

The conventional wisdom swirling around is that millennials are:

-

-

Tech savvy

-

Obsessed with their cell phones, social media and the Internet

-

Not that concerned about money

-

Possessed with strong sense of community and civic duty

-

And more…

-

What do these characteristics tell us about the banking needs of a millennial? NOTHING. First, there isn’t even a clear definition of millennials – they’ve been defined as individuals with birth dates ranging from 1982-2004, 1982-2000, or 1981-1996. For the purpose of this discussion, let’s focus on those born between 1981 and 1996. Using this definition the ages for this group could be anywhere between 22 to 37 years old (a 15 year span!).

Age is just a number.

Age is just a number, and in bank sales and marketing it’s really not a very telling one. Based on recent analysis by FI Works, annual income for individuals between 22 and 37 years of age can be anywhere from under $15,000 to over $125,000. That helps put the problem of treating all millennials the same into perspective a bit more. Conclusion – if you are trying to target millennials based on the generalized rubbish above – GOOD LUCK!

It’s not that targeting the younger generations is a mistake, but there is a better way to go about it. Quite frankly, the approach to marketing to millennials shouldn’t be any different than the way banks should target any banking segment. Banks have to move away from “spray and pray” marketing based on assumptions, gut feel or simple segmentation. It’s too expensive and rarely pays for itself.

Community banks have to get smart about sales and marketing.

Community banks have to get smart about how they market to their customers – otherwise they will struggle to survive. Customers expect to have a relationship with their community bank and for their bankers to know them. It’s not about assumptions made based on age or income, it’s about anticipating your customers’ financial needs and proactively presenting messaging and offers that are germane to them. A recent Harris Poll Survey showed that three out of five banking customers expect their bank to anticipate their needs.

61%

Banking Customers want (expect) their bank to anticipate their financial needs the same way online retailers do.

Source: D3 Banking Technology/Harris Poll Survey 2018

How do you predict customers’ needs? Sound like voo-doo magic? Well it’s not. Think about consumers and how online retailers market to them. Based on their interests, purchases, and online activities retailers present ads for additional products that are of interest. This approach is steeped in heavy customer analytics and seen as highly intelligent by consumers. More importantly, it reaps huge returns for the retailers.

The good news is that in banking there are huge amounts of data available about customers. However, the type of customer analytics we are talking about is not something that is possible for the human brain or spreadsheets to accomplish. It requires advanced Artificial Intelligence (AI) and Machine Learning techniques to truly predict the banking needs of customers and score the readiness of individual households for different banking products. Today there are tools that leverage AI/Machine Learning, but are affordable and accessible for banks of any size.

A MUCH better way. Know who to target and how to market to them!

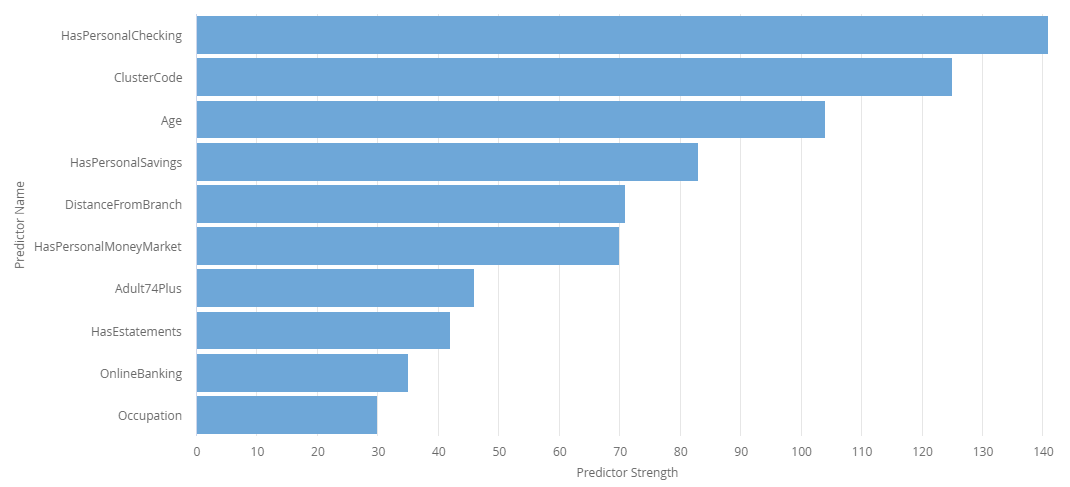

There is a better way to approach community bank marketing that will produce amazingly better results. Using the type of analytical tools we’ve described above even goes beyond the type of information available if you leverage segmentation systems, (Nielsen P$ycle, Acxiom Personicx). It takes a much deeper dive into understanding your customers’ behaviors and understanding the most important factors that will enable you to arrive at fact-based conclusions.

Banking Customer Behavior Predictors

(Ranked by Importance)

Using this approach, a bank can build intelligent campaigns by answering these types of questions:

- What customers are most likely to use overdraft protection?

- How can we identify customers/prospects that need a money market account?

- What characteristics define models that would identify the best new customer targets for your newly acquired branch?

- What deposit products would be most appealing for each of your current customers?

- What trends/factors are driving attrition in your high-value segments?

- How do different segments respond to offers?

- How do deposit categories are shrinking/growing – and why?

- Are there geographic factors that are affecting product need or offer responses?

The proof is in the numbers. Spend less. Make more.

So how should you market to millennials? That really isn’t the question you should be focused on. Focus on knowing how your customers behave and what they need. Drive your sales and marketing campaigns from analytics that answer the types of questions above and your community bank will be much better positioned to thrive.

If you dig deeper to understand your customers, I assure you that your bank will be able to drive smarter marketing that’s personalized and relevant to your customers/targets. Campaigns will cost less and produce quantifiably higher results. This approach to marketing works. The proof is in the numbers. Click here to see some of our customers’ campaign results.