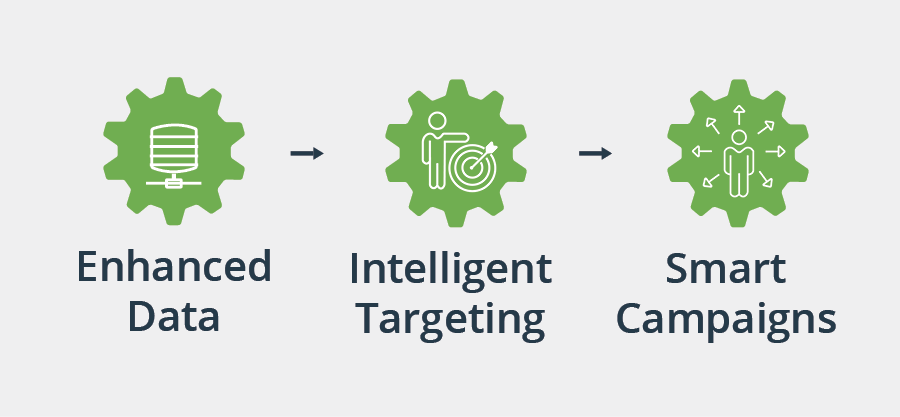

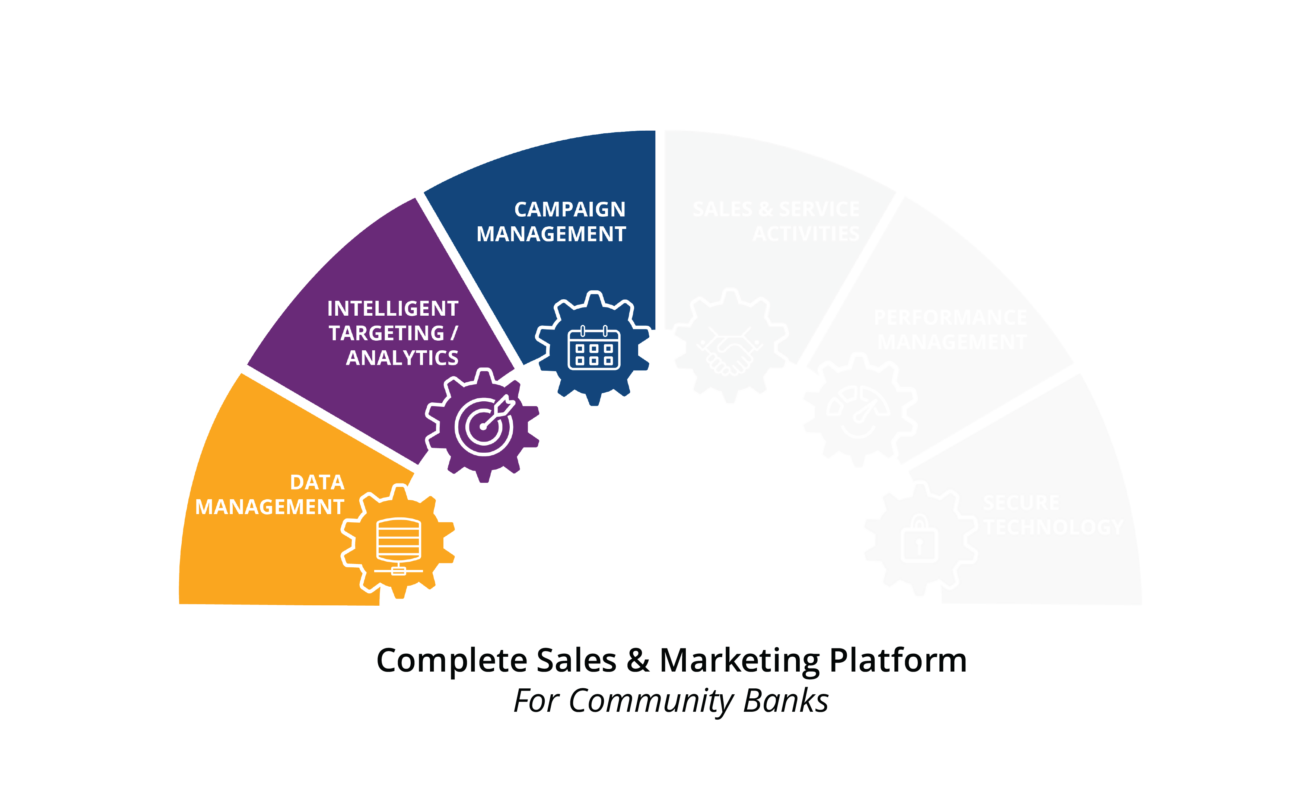

We return to our series on key growth initiatives for community financial institutions with a new article on the benefits of smarter campaign management. In our first installment, we detailed data management, and how important it is for a financial institution to properly manage their plethora of data. Then we tackled data analytics and what we like to call intelligent targeting, where you make the best use of properly managed data to find and reach out to the right customers.

But how can you turn these new data insights into action? By creating data-driven, smart marketing campaigns you can leverage multichannel strategy, employ automation, and effectively acquire, retain, and develop deeper relationships with customers. When financial institutions are finally able to harness their data and learn from it, they can use it to their advantage to grow deposits and build relationships. Smart campaigns are a powerful marketing practice that brings in business without breaking the bank because you’re utilizing a resource you already have – data. Now more than ever, community banks and credit unions need cost-effective and efficient campaigns to directly meet the changing needs of their customers and members.

What are Smart Campaigns?

Smart campaigns are cost-efficient, data-driven, marketing campaigns based on intelligent targeting.

Smart campaigns make the insights gathered from your data actionable. These campaigns are purposeful because decisions are made using the power of data to discover what kinds of products or services your customers or prospects may want or need.

There are a few requirements before getting started on creating these smart campaigns. You can’t employ proper campaign management without first integrating your data and enhancing it with intelligent targeting and analytics. The campaigns themselves are an extension of these requirements, and they won’t work as efficiently if your data is erroneous or if you target just anyone.

It’s tempting to make assumptions about prospects and even your current customers. This can lead you down an expensive and wasteful path if you don’t use your data to directly guide your marketing. Campaigns that rely on data and targeting narrow down the exact people you need to convey your message to based on their needs. Banks have more data on their customers than any other industry, so why not use it? With integrated data, intelligent targeting, and smart campaigns, you can even reach out to prospects that mirror your ideal customer, effectively growing your customer base with qualified leads.

Why do you need smarter and more efficient campaigns?

Offers are not one-size-fits-all. Inappropriate offers for products that are not relevant to your customers negatively affects the relationship and leads to higher attrition (which averages at 15% per year for financial institutions!). Instead of scrambling and spending valuable marketing dollars to replace customers lost, use data-driven smart marketing campaigns. These are based on customer needs, not the products you most want to sell.

Guessing and intuition marketing don’t work anymore. Still using saturation methods like selecting ZIP codes? Don’t waste your time or money. Sending inappropriate offers will only annoy your customers and prospects and response rates will be poor.

Community institutions are naturally more focused on relationships. You know the pain points of your customers and members or certain products that could positively impact a customer’s lives. Offering a product or service that data tells you is based on a real need works a lot better than a shot in the dark. You can then show the unique value that differentiates your institution. It’s no secret that the big banks are already marketing to your customers, but you can prove that you know your community and its needs more than a larger institution could.

Measurement is key. Measurement is a more programmatic approach to marketing that makes future campaigns much easier, providing you with a complete view of your campaigns so you know what worked. In order to measure the success of a given campaign you’ll want to know who opened your emails and who returned your calls and why they decided to do so. You want to know what helped them make the decision. But how do you accurately find this information? This can be done by enabling attribution models that can show how customers responded after interacting with your different marketing campaigns. It also helps line up which of your employees made the call or successfully closed the deal.

READ MORE ABOUT DATA INSIGHTS:

Why Data Management is the Foundation for Sustainable Growth

Leverage your channels

A few months ago, we blogged about leveraging multi-channel marketing. To learn more about multi channel marketing, click here.

Think about the ideal customer when choosing your channels. How did you reach those that are already the kind of customers you want? How do your current customers respond to different channels? Mix both digital AND traditional channels to get the best results. But remember, what would be effective marketing to one customer segment will not be exactly the same across the board.

When using different channels, be strategic. Here are our best recommendations:

- Smart campaigns are not one-and-done – Using only one channel for one offer for one customer only once won’t be as effective as using two or more complimentary channels.

- Be sure to use different channels together as multipliers of your overall marketing strategy – your channels should be working as a team toward your goals.

- Channels need to be complimentary – For example, if a consumer is browsing social media and they see a targeted ad for your financial institution, then later see a billboard or print ad, their awareness has been raised. Then when they are looking for a product you have, they are more likely to think of you. These two channels complimented each other.

Big banks like Citi and Bank of America seem to spend a great deal of money and resources on mailers. With smarter campaigns, you don’t have to spend tons of money on marketing because your specific targets have been made clear, and the data shows they actually want or need your products. Adopting smart campaigns helps you multiply marketing efforts without the hefty price tag.

Why is Automation Important?

Automation is the practice of using technology to execute certain tasks, helping maintain consistency and efficiency while saving valuable time for your employees. But, automation doesn’t just mean completing activities here and there for customers without employee involvement. Automation also means you have the ability to leverage data and technology to create systemic marketing plans, meant to be executed daily to achieve real results. Automation augments tasks for bankers by facilitating conversations and helping to manage other relationship building activities.

For example, with automated onboarding a customer’s journey is monitored and tracked to create a smoother process and save your institution time while taking care of them each step of the way. You can set up automated email campaigns to guide the customer at the beginning of the relationship (like just opening a checking account) at different time increments (1 day, 30 days, 1 year). Automation is the foundation of smooth, efficient onboarding, and many financial institutions are already utilizing that aspect. You can use this same sort of practice across different campaigns and processes to really see big results.

With automated customer service, you can set up automatic reminders or emails that can help resolve problems, answer questions, and keep customers informed. Data-driven automation can even notify your customer service representatives to reach out to customers with higher attrition risk. Data-based automation gives you the tool to drive those conversations that build and deepen your relationships and it saves your team lots of time by doing the hardest stuff for you.

The proof in the numbers

Customer retention, customer acquisition, and shallow relationships are some major growth pain points for community financial institutions that smarter campaigns can help resolve.

Other things to remember:

-

- Good marketing doesn’t fix uncompetitive products or bad rates — you still must make a competitive offer. Even with the best intelligent targeting and the best marketing in the world, offering poor rates won’t bring in the new business you want.

- Copy/creative are also important — here is where consistency shines through! Utilize your branding and have a clear call-to-action for your customers to execute. Like we mentioned above, all your messaging through all channels should be complementary.

- Always ask which channel (or channels) is the best channel for each campaign. And remember that ideal customer — how would they respond to marketing through different channels?

- Repeat campaigns that worked well! Using the measuring techniques we detailed above, you can better see which of your campaigns are most effective.

With a greater understanding of smart campaigns, you are equipped to make the insights from your data actionable. The benefits of greater efficiency in your campaigns are numerous, saving you resources and time in the long run. Customers and prospects will appreciate your efforts to understand and meet their needs. Marketing operations will run smoothly and your customer base will grow.

Smart campaigns are the next step toward robust relationship management practices, which we will discuss in our next post about CRMs and sales activities. Then, we will cover the importance of profitability and performance measurement and how to effectively get each member of your team on the same page. Stay tuned!

Like this post? Don’t forget to share!