Community financial institutions must take control of their data if they want to compete in the banking industry.

How often have you asked for information and then were told that you cannot get to it because the data is in two different systems? Most bankers know that they have a data dilemma, but why is it so difficult to crack? A typical bank has over 500 million data elements per $1 billion in assets, and yet this invaluable information is underutilized because community banks just don’t know how to confront it.

Banking titans like JPMorgan and Citigroup are investing millions into integrating and comprehending data because they realize the incredible value of this mass amount of customer information. What are you doing to leverage your data?

Bank information is contained in multiple systems that represent silos of data that are far from integrated. Some financial institutions have up to 20 different silos, which makes understanding the customer nearly impossible. If you only have a partial view of the customer, it limits your ability to make better business decisions. Your most complex relationships are often the most valuable, but they are the hardest to understand.

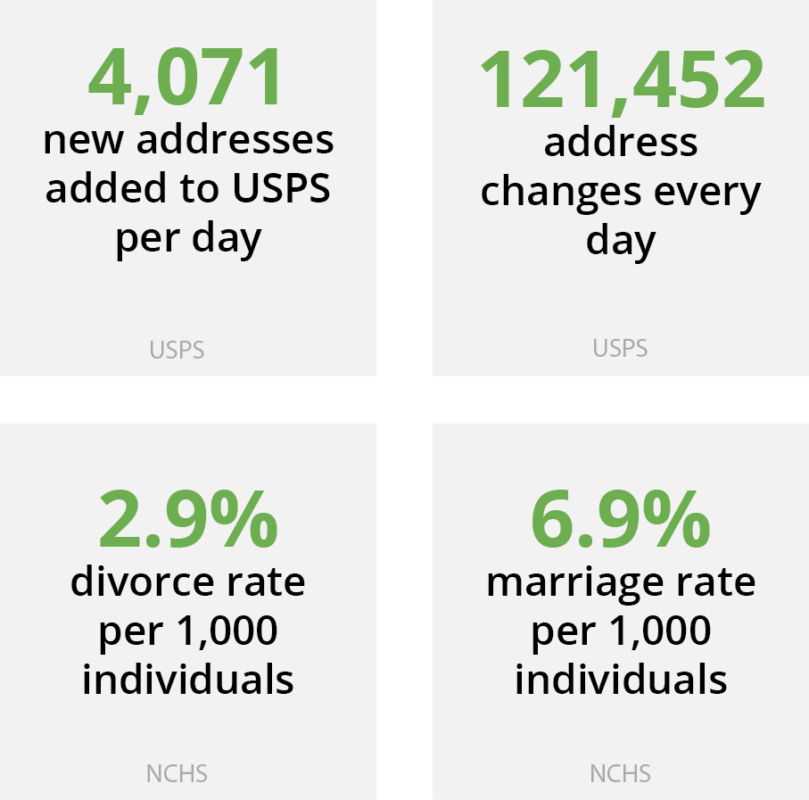

Unfortunately, data silos are not the only issue. Customer and account information in core systems are also a moving target. Studies show that 25-30% of customer data changes each year which has banks scrambling to keep their footing. Customers change their information as their life stage changes. They move, marry or divorce, change their names, get new phone numbers and change their email address. More than likely, they are not going to contact you about most of these changes.

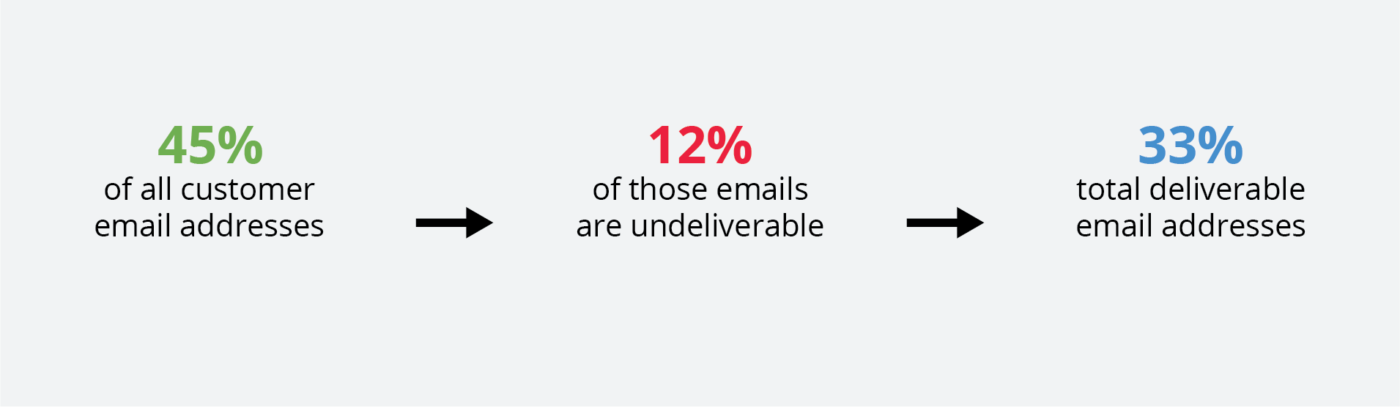

One of our studies revealed that a typical bank has only 45% of their customer’s email addresses on file. From there, we found that 12% of these addresses were undeliverable, which can leave you with valid email addresses of around 33%. Additionally, 20% of people in the US change their email addresses every year. How can you advance digitally with such a low deliverability percentage? Email addresses are the cornerstone of digital initiatives and they need to be continually updated and diligently integrated.

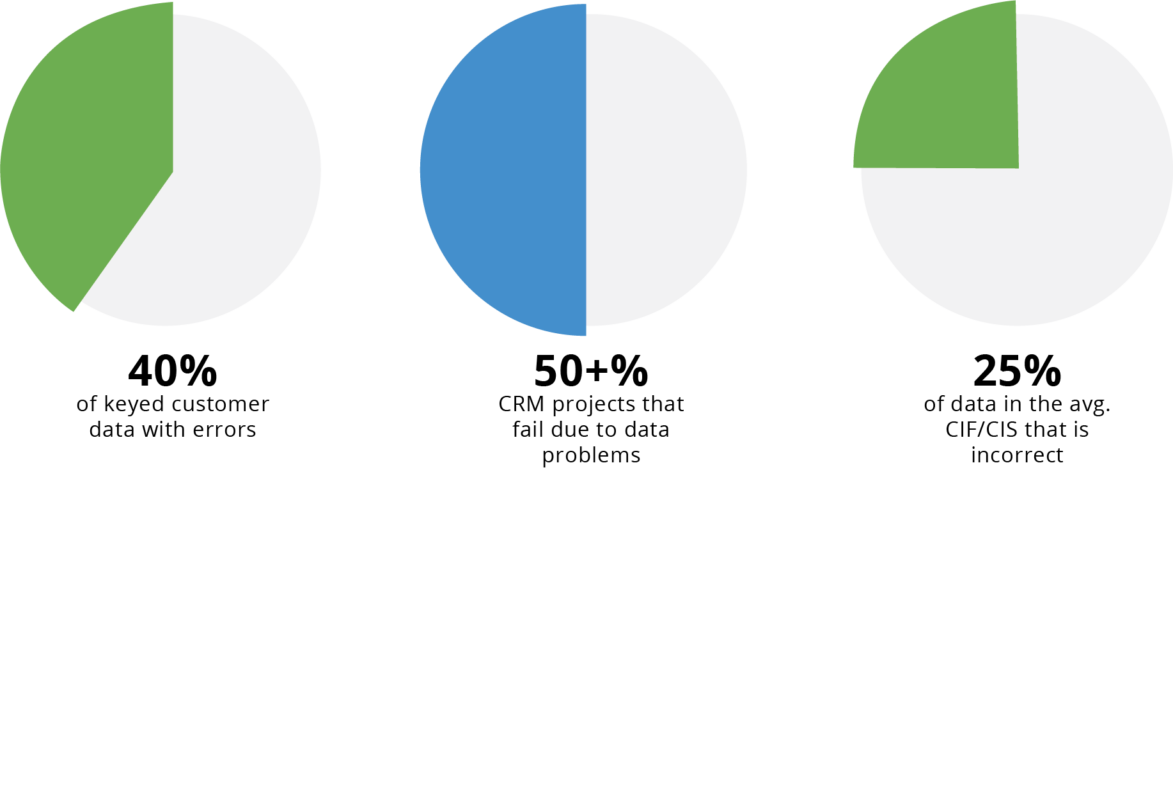

Customer data is often entered manually into bank systems resulting in typos, transposed characters, and ultimately invalid data. Even worse, data is rarely corrected after it is entered.

Because of these challenges, data decays at a rate of up to 3.4% each month. Data decay is the gradual loss of data quality. This decay is ongoing through any changes in individuals or businesses and it is easy to get lost in piles of invalid or simply outdated data.

How can you add value for your customers with erroneous data? How can you employ this cluttered information to make decisions? How can you see a complete view of the customer? This is precisely what we call the data dilemma.

Let’s take a look at how the data dilemma impacts some of your top strategic goals and how you can solve the problem.

The 360 Degree View

What has been known as the 360 Degree View of the customer is more relevant than ever in today’s banking climate. You have to understand the needs and wants of the customer before you are able to adequately use your data to your advantage. Subsequently, to understand this view of your customer you must grasp the 3 C’s of the 360 Degree View. Ask yourself if the data is:

Complete

Consistent

Correct

The data must be Complete – Every bit of information you have about a customer must be in one place and readily accessible by everyone at any level in your institution.

The data must be Consistent – Everyone must be looking at the customer in the same way. From analytical processes to retail delivery channels, the same information about the customer must be used so that you have a single version of the truth.

The data must be Correct – Correct or remove incorrect data entirely so your employees believe in it. If people don’t trust data, they certainly will not use it.

While these are simple principles, they are difficult to follow on a continuous basis. This requires commitment from your senior leadership team. To get that kind of commitment, you have to understand how the data dilemma directly affects key strategic initiatives.

How is your data dilemma tampering with your ability to grow deposits?

There are three well-known strategies that financial institutions use to grow deposits:

- Improving and growing relationships

- Acquisition of the right deposit customers

- Retaining valuable deposit customers

These may seem simple enough, but the data dilemma makes it very difficult to execute these strategies.

One thing is certain: knowing your customer is not optional. So, how can a financial institution use clean data to increase deposits?

1. Improving and Growing Relationships

-

- Providing personalized service

- Needs-based selling (a sure way to anger a customer is to sell inappropriate products that they don’t need)

Responsibly cross-selling to your customers cannot work if you attempt to sell them something they already have. Do not exasperate them by attempting to sell them a savings account if they already have a savings account. Do not try to sell them a CD if they aren’t likely to need one. Too many marketing initiatives are focused on what you need to sell and not what the customer needs.

Integrated data gives you the ability to provide value to your customers with a personalized relationship and products they actually need. Utilize your data to understand your customers and answer your questions about them, discover their needs, and deliver that to them.

2. Acquisition of the Right Deposit Customers

It is hard to know what prospects would make the best deposit customers if you do not understand your current customers. How will you know what a prospective customer looks like if you have little idea of how to compare them to your current ones? Start here first, and remember to not get ahead of yourself: you must understand your current customers before you go out looking for new ones. Use that knowledge to focus your acquisitions efforts. You will not only save on marketing expenses, but you will gain customers with higher value and lower attrition as a result.

3. Retaining Valuable Deposit Customers

Retaining customers starts with the ability to know which customers are leaving and why they left in the first place. Some institutions gather the latter via surveys, but that information is rarely integrated into their systems. Understanding your attrition patterns also aids in fine-tuning onboarding relationship programs. Are you still stuck with the old 2-2-2 pattern? Here you must ask yourself if that really matches your current attrition pattern. Banks have rich data that can be used to predict attrition IF that data is integrated properly.

How is your data dilemma interfering with your adoption of digital?

We all know that email is a great way to communicate with customers and lower direct mail costs, but as covered earlier many banks have a very low percentage of valid email addresses. Combined with 20% of people changing their email address every year, you have a data dilemma preventing you from optimizing email marketing successfully.

Banks have multiple silos of systems that contain a valid email address. The trick is to integrate these addresses into the marketing database as well, and to continually clean and update it.

What if a customer doesn’t have an email address or digital device? Promote services that require email addresses like e-statements, online banking, bill pay, and mobile banking. Then, generate tasks for your bankers to gain new or updated email addresses within each interaction.

How is the data dilemma impairing your ability to leverage AI?

Artificial Intelligence (AI) can help financial institutions in many ways: fraud, credit risk, cross-selling, and retention to name a few. However, AI projects live and die based on the ability to provide clean, integrated data to AI models.

Without solving the data dilemma, you cannot incorporate artificial intelligence into your data regimen. To correctly take advantage of AI, you need to ask the right questions about your data, your customers, and the campaigns you can conduct. Does your data have the ability to answer your business questions?

READ MORE ABOUT DATA INSIGHTS:

Why Data Management is the Foundation for Sustainable Growth

Make Your Data Insights Actionable with Smart Campaigns

Practical ways to solve the dilemma

Now that you are armed with the knowledge of what can hold you back, how can you solve this data dilemma? Data is an asset to any financial institution and you must be a steward of it. Want to elevate your financial institution and rise among the rest? Here are some tips:

-

- Identify which of your data sources contain customer information

- Prioritize what you need to integrate first

- Commit to processes and technology that continuously clean and integrate your data

- Validate, standardize, and audit your data regularly

- Come up with a plan to integrate your silos using data matching

- Don’t do this alone – partner with a company with the experience and sophisticated tools needed to help fix your problem

Seem hard? We’re here to help

A common misconception is that a community institution cannot afford business partners with intelligent software platforms. While the big banks are investing billions into data integration, there are companies in place to help banks of any size do just that. If you start now, you can avoid the inevitable messy pile up and start really seeing the results of your marketing efforts. It’s time to look beyond your core system– there is so much more to see! Click here to see how FI Works can help integrate your data and to learn how investing in us will pay off.